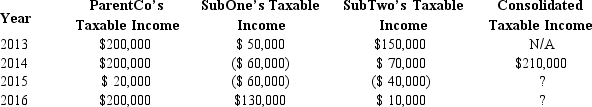

ParentCo, SubOne and SubTwo have filed consolidated returns since 2014. All of the entities were incorporated in 2013. Taxable income computations for the members include the following. None of the group members incurred any capital gain or loss transactions during these years, nor did they make any charitable contributions.  How should the 2015 consolidated net operating loss be apportioned among the group members?

How should the 2015 consolidated net operating loss be apportioned among the group members?

ParentCo SubOne SubTwo

Definitions:

Appraisal Right

A dissenting shareholder’s right to have his or her shares appraised and to receive monetary compensation from the corporation for their value.

Shareholder Vote

An act where individuals or entities holding shares in a corporation participate in deciding on corporate matters through voting.

Consolidation

The process of combining multiple debts, loans, or businesses into a single new loan or corporate entity.

Legal Existence

A term indicating that an entity is recognized under the law as having legal rights and obligations.

Q21: On August 31 of the current tax

Q33: In a redemption of § 306 stock,

Q37: A corporation generally will recognize gain or

Q57: Dark, Inc., a U.S. corporation, operates Dunkel,

Q62: Emma's basis in her BBDE LLC interest

Q78: Distribution of cash of $100,000 to a

Q87: Which of the following is an election

Q96: ABC LLC reported the following items on

Q97: On December 31 of last year, Maria

Q102: Blue Corporation has a deficit in accumulated