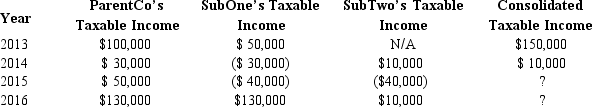

ParentCo and SubOne have filed consolidated returns since 2012. SubTwo was formed in 2014 through an asset spin-off from ParentCo. SubTwo has joined in the filing of consolidated returns since then. Taxable income computations for the members include the following. None of the group members incurred any capital gain or loss transactions during these years, nor did they make any charitable contributions.  If ParentCo does not elect to forgo the carryback of the 2015 net operating loss, how much of the 2015 consolidated net operating loss is carried back to offset prior years' income?

If ParentCo does not elect to forgo the carryback of the 2015 net operating loss, how much of the 2015 consolidated net operating loss is carried back to offset prior years' income?

Definitions:

Self-Serving Bias

The common human tendency to attribute positive events to their own character but attribute negative events to external factors.

Personal Experience

An individual’s direct observation or participation in events, forming the basis for knowledge, attitudes, or beliefs.

Inherited

The transfer of physical, genetic, or characteristic traits from parents to offspring through genes.

Innate

Qualities, abilities, or knowledge that are inborn or present naturally rather than acquired.

Q14: Hawk Corporation has 2,000 shares of stock

Q20: Brown Corporation purchased 85% of the stock

Q60: Economic effect test

Q66: Ashley purchased her partnership interest from Lindsey

Q74: Parent's basis in the stock of Child,

Q91: Blaine contributes property valued at $50,000 (basis

Q99: A Federal consolidated filing group aggregates its

Q107: On a partnership's Form 1065, which of

Q146: ParentCo and SubCo recorded the following items

Q154: In computing consolidated taxable income, a net