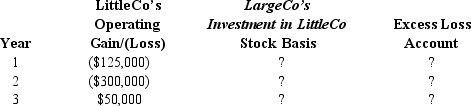

LargeCo files on a consolidated basis with LittleCo. The subsidiary was acquired for $400,000 on January 1, Year 1, and it paid a $75,000 dividend to LargeCo at the end of both Year 2 and Year 3.

a. Given the following information about the subsidiary's operating results, derive the requested amounts as of December 31 of each year. The group files using a calendar year.

b. LargeCo sold LittleCo to an unrelated competitor for $600,000 on December 31, Year 3. How will LargeCo account for this sale?

Definitions:

General Partner

An owner of a partnership who has unlimited liability and is responsible for the management of the partnership.

Liability For Firm Debts

Obligations a company must meet, including all debts and financial responsibilities.

Agency Cost

Costs that arise from conflicts of interest between managers and shareholders within a company.

Executive Overseas

A managerial position held within a company's operations located in a foreign country.

Q22: Which of the following entities is eligible

Q23: Which of the following would not prevent

Q38: Purple Corporation has two equal shareholders, Joshua

Q41: When the transactions are so interdependent that

Q43: Inventory with a basis of $10,000 and

Q85: Samuel is the managing general partner of

Q88: The gains shareholders recognize as a part

Q88: The amount of a partnership's income and

Q132: In working with the foreign tax credit,

Q140: Inventory with a basis of $10,000 and