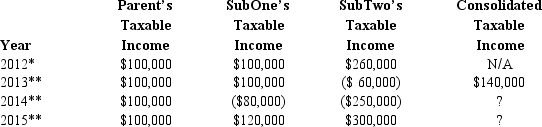

Parent Corporation, SubOne, and SubTwo have filed consolidated returns since 2013. All of the entities were incorporated in 2012. None of the group members incurred any capital gain or loss transactions during 2012-2015, nor did they make any charitable contributions. Taxable income computations for the members are listed below.

* Separate return year.

* Separate return year.

** Consolidated return year.

a. How much of the 2014 loss is apportioned to SubOne and SubTwo? How is this loss treated in generating a refund of prior tax payments?

b. Why would Parent consider electing to forgo the carryback of the 2014 consolidated NOL?

c. In this light, analyze the election to consolidate.

Definitions:

Distributions-in-Kind

Non-cash assets paid out to investors or partners from a firm or fund.

Partnership's Assets

Items of value owned by a partnership that are used or can be used to conduct its business.

Economic Viability

The ability of an entity, project, or activity to sustain its operations and make a profit over the long term.

Wrongful Dissociation

In the context of business partnerships or limited liability companies, this term refers to the improper withdrawal of a partner or member from the business, breaching the operating agreement and possibly resulting in liability.

Q28: Bighley shows the following results for the

Q28: Sparrow Corporation purchased 90% of the stock

Q35: Carl transfers land to Cardinal Corporation for

Q35: SubCo sells an asset to ParentCo at

Q55: Which of the following is an incorrect

Q66: Under certain circumstances, a distribution can generate

Q94: Gain realized (but not recognized) on a

Q123: On January 1, Tulip Corporation (a calendar

Q125: ParentCo, SubOne and SubTwo have filed consolidated

Q160: Which of the following statements regarding the