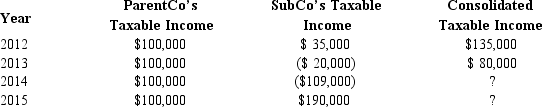

ParentCo and SubCo have filed consolidated returns since both entities were incorporated in 2012. Taxable income computations for the members include the following. Neither group member incurred any capital gain or loss transactions during these years, nor did they make any charitable contributions.  The 2014 consolidated loss:

The 2014 consolidated loss:

Definitions:

Archetype

A universally recognized symbol or character that recurs across cultures and literature, representing fundamental human experiences.

Temperament

An individual's innate predisposition towards emotional reactivity and intensity, influencing their behavior and interactions.

Psychodynamic Theorist

A psychologist or psychiatrist who applies the theories and practices of the psychodynamic approach, focusing on unconscious processes and childhood experiences.

Rational Decision Makers

Individuals or entities that make choices that maximize benefits while minimizing costs, based on available information and rational analysis.

Q22: Which of the following statements is correct

Q29: Briefly describe the reason a corporation might

Q47: If a partnership allocates losses to the

Q63: The basis for the acquiring corporation in

Q92: Regardless of any deficit in current E

Q93: Foreign tax credit or deduction

Q95: Julie is an active owner of a

Q98: The MBA Partnership makes a § 736(b)

Q109: Step down

Q151: Winnie, Inc., a U.S. corporation, receives a