Multiple Choice

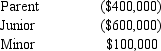

The Philstrom consolidated group reported the following taxable income amounts. Parent owns all of the stock of both Junior and Minor. Determine the net operating loss (NOL) that is apportioned to Parent.

Understand and apply the principles of inventory management to special cases such as perishable goods and seasonal demand.

Calculate the total inventory costs under different inventory management strategies.

Determine the most cost-efficient inventory policy in scenarios with uncertain demand.

Understand the trade-off between service level, safety stock, and inventory costs.

Definitions:

Related Questions

Q13: Hendricks Corporation, a domestic corporation, owns 40

Q24: Dividends received deduction.

Q52: For corporate restructurings, meeting the § 368

Q70: Binding nature of election over multiple tax

Q85: Federal income tax paid in the current

Q93: Foreign tax credit or deduction

Q96: ABC LLC reported the following items on

Q105: Compare the sale of a corporation's assets

Q111: Yoko purchased 10% of Toyger Corporation's stock

Q133: In the current year, the DOE LLC