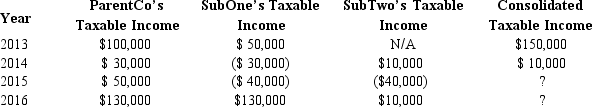

ParentCo and SubOne have filed consolidated returns since 2012. SubTwo was formed in 2014 through an asset spin-off from ParentCo. SubTwo has joined in the filing of consolidated returns since then. Taxable income computations for the members include the following. None of the group members incurred any capital gain or loss transactions during these years, nor did they make any charitable contributions.  If ParentCo does not elect to forgo the carryback of the 2015 net operating loss, how much of the 2015 consolidated net operating loss is carried back to offset prior years' income?

If ParentCo does not elect to forgo the carryback of the 2015 net operating loss, how much of the 2015 consolidated net operating loss is carried back to offset prior years' income?

Definitions:

Interest

The cost of borrowing money or the payment received for saving or investing money, typically expressed as an annual percentage of the principal.

Nominal Rate

The interest rate stated on a financial product, not adjusted for inflation.

Effective Rate

The actual interest rate an investor earns or pays on an investment or loan, taking into account the effects of compounding.

Compounding Interval

The frequency at which interest is added to the principal amount of an investment or loan, influencing the total amount of interest earned or paid.

Q16: JLK Partnership incurred $6,000 of organizational costs

Q38: Similar to likekind exchanges, the receipt of

Q74: A corporate shareholder that receives a constructive

Q78: Profits interest

Q83: Carries over to new corporations in a

Q109: Step down

Q124: The LN partnership reported the following items

Q125: Rebecca is a limited partner in the

Q130: In the current year, Warbler Corporation (E

Q150: The rules for computing Federal consolidated taxable