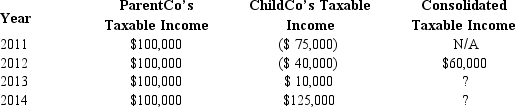

ParentCo purchased all of the stock of ChildCo on January 2, 2012, and the two companies filed consolidated returns for 2012 and thereafter. Both entities were incorporated in 2011. Taxable income computations for the members include the following. Neither group member incurred any capital gain or loss transactions during these years, nor did they make any charitable contributions. No § 382 limit applies.  To what extent can ChildCo's 2011 losses be used by the group in 2014?

To what extent can ChildCo's 2011 losses be used by the group in 2014?

Definitions:

Congruent Interests

A scenario in which the objectives or goals of two or more parties align, facilitating cooperation and mutual benefits.

Moral Identity

The degree to which being a moral person is central to an individual's identity, influencing their actions and decisions.

Formalism

A specific method, convention, or approach characterized by its emphasis on form and structure in the arrangement of elements.

Moral Development

The process by which individuals develop their understanding of what is right and wrong, often influenced by societal norms and personal experiences.

Q57: The "Type B" reorganization requires a continuity

Q61: Target shareholders recognize gain or loss when

Q68: Gabriella and Maria form Luster Corporation with

Q71: Federal income tax refunds from tax paid

Q78: Zhang, an NRA who is not a

Q89: If there is a balance in the

Q108: The partnership reports each partner's share of

Q112: Landis received $90,000 cash and a capital

Q137: ParentCo's separate taxable income was $200,000, and

Q153: Present, Inc., a U.S. corporation, owns 60%