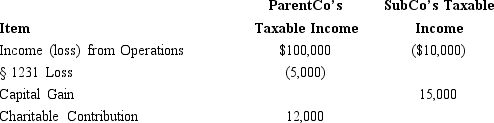

ParentCo and SubCo had the following items of income and deduction for the current year.  Compute ParentCo and SubCo's consolidated taxable income or loss.

Compute ParentCo and SubCo's consolidated taxable income or loss.

Definitions:

Reality

The state of things as they actually exist, as opposed to an idealistic or notional idea of them.

Flavell

An American developmental psychologist known for his research on cognitive development and metacognition, particularly in children.

Competence

The ability to effectively perform or achieve a specific task or function.

Performance

The act or process of carrying out an action or task, often evaluated in terms of effectiveness, skill, or efficiency.

Q22: Which of the following entities is eligible

Q37: The taxable income of a partnership flows

Q40: In computing consolidated taxable income, capital gains

Q49: Maria owns a 60% interest in the

Q61: In a limited liability company, all members

Q77: Which of the following statements regarding income

Q105: USCo, a U.S. corporation, reports worldwide taxable

Q152: A penalty can be assessed by the

Q155: During the current year, USACo (a domestic

Q161: Britta, Inc., a U.S. corporation, reports foreign-source