TopCo owns all of the stock of BottomCo. Both taxpayers are subject to the alternative minimum tax (AMT) this year for the first time, due to a dependence on accelerated MACRS deductions. The corporations incurred no intercompany transactions during the year. TopCo has a consolidation election in effect for the group.

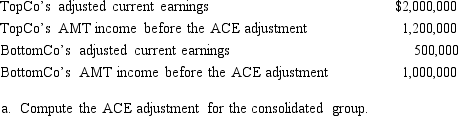

If the affiliates were to file separate Forms 1120 this year, the following amounts would be reported.

a. Comment on the effects of the consolidation election on the companies' AMT liabilities.

Definitions:

Interval Estimate

An estimate of a population parameter that provides a range of values instead of just a single point.

T Distribution

A type of probability distribution that is symmetric and bell-shaped, used in statistics for small sample sizes when the population standard deviation is unknown.

Sample Sizes

Refers to the number of individual samples or observations used in a survey or experimental study.

Interval Estimate

A range of values constructed from sample data within which the population parameter is estimated to lie, given a specified level of confidence.

Q6: Brown Corporation, an accrual basis corporation, has

Q7: A shareholder contributes land to his wholly

Q58: A realized gain from an involuntary conversion

Q84: The JPM Partnership is a US-based manufacturing

Q102: Fern, Inc., Ivy, Inc., and Jeremy formed

Q134: Constructive liquidation scenario

Q140: The right to file on a consolidated

Q160: Gold and Bronze elect to form a

Q162: An advance pricing agreement (APA) is used

Q167: Parent owns 100% of a Brazil corporation