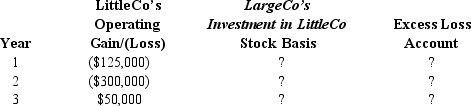

LargeCo files on a consolidated basis with LittleCo. The subsidiary was acquired for $400,000 on January 1, Year 1, and it paid a $75,000 dividend to LargeCo at the end of both Year 2 and Year 3.

a. Given the following information about the subsidiary's operating results, derive the requested amounts as of December 31 of each year. The group files using a calendar year.

b. LargeCo sold LittleCo to an unrelated competitor for $600,000 on December 31, Year 3. How will LargeCo account for this sale?

Definitions:

Middle Distance Runners

Athletes who specialize in running races that are longer than sprints and shorter than long-distance races, typically ranging from 800 meters to 3000 meters.

Confidence Interval

A range of values, derived from sample statistics, that is likely to contain the value of an unknown population parameter at a given confidence level.

Mean Difference

The average difference between each of two sets of numbers, often used in statistical analysis to compare two groups.

Math Scores

Quantitative assessments of individuals' proficiency in mathematics, typically resulting from tests or examinations.

Q4: Which of the following statements is true,

Q11: When the § 382 limitation is evoked,

Q20: General partner

Q21: During the current year, Ecru Corporation is

Q33: In a redemption of § 306 stock,

Q71: U.S. individuals who receive dividends from foreign

Q125: Given the following information, determine whether Greta,

Q135: Distribution of cash of $60,000 for a

Q148: Which of the following entities is eligible

Q152: A penalty can be assessed by the