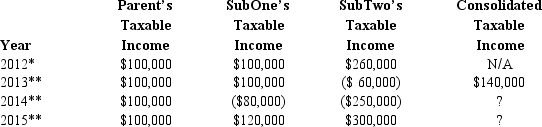

Parent Corporation, SubOne, and SubTwo have filed consolidated returns since 2013. All of the entities were incorporated in 2012. None of the group members incurred any capital gain or loss transactions during 2012-2015, nor did they make any charitable contributions. Taxable income computations for the members are listed below.

* Separate return year.

* Separate return year.

** Consolidated return year.

a. How much of the 2014 loss is apportioned to SubOne and SubTwo? How is this loss treated in generating a refund of prior tax payments?

b. Why would Parent consider electing to forgo the carryback of the 2014 consolidated NOL?

c. In this light, analyze the election to consolidate.

Definitions:

Observational Learning

Learning that occurs through observing the behaviors of others and the outcomes of those behaviors.

Specific Phobia

An intense, irrational fear of a specific object, situation, or activity that leads to avoidance behavior.

Fearful Response

A psychological and physiological reaction to perceived threats, involving fear or anxiety.

Genetic Influences

The impact of genes inherited from parents on the physical and behavioral characteristics of an individual.

Q11: Ann transferred land worth $200,000, with a

Q12: Pink Corporation declares a nontaxable dividend payable

Q82: Where are the controlling Federal income tax

Q85: With respect to income generated by nonU.S.

Q91: Given the following information, determine if FanCo,

Q94: Leon owns 750 shares of the 2,000

Q99: If a liquidation qualifies under § 332,

Q101: Charitable contribution carryforward deducted in the current

Q109: Step down

Q114: The "inside basis" is defined as a