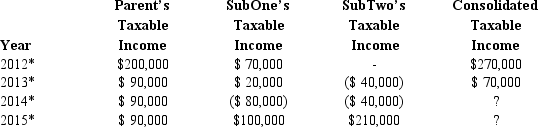

The group of Parent Corporation, SubOne, and SubTwo has filed a consolidated return since 2013. The first two entities were incorporated in 2012, and SubTwo came into existence in 2013 through an asset spin-off from Parent. Taxable income computations for the members are shown below. None of the group members incurred any capital gain or loss transactions during 2012-2015, nor did they make any charitable contributions.

Describe the treatment of the group's 2014 consolidated NOL. Hint: Apply the offspring rule.

* Consolidated return year.

* Consolidated return year.

Definitions:

Income

The proceeds gained, frequently on an ongoing basis, from professional work or capital allocations.

Pork Chops

Pork chops are cuts of meat from the pig, situated perpendicular to the spine, and are among the most popular pork cuts in various cuisines.

Lamb Chops

Cuts of meat from the rib, loin, or shoulder of a lamb, often grilled, broiled, or roasted.

Normal Good

A good for which demand increases as consumer income rises, holding everything else constant.

Q15: If the acquiring corporation purchased 25% of

Q16: JLK Partnership incurred $6,000 of organizational costs

Q27: Which of the following statements is true

Q36: Inventory

Q38: Robin Corporation, a calendar year taxpayer, has

Q55: Originally, the Supreme Court decided that corporate

Q80: If a shareholder owns stock received as

Q90: Columbia, Inc., a U.S. corporation, receives a

Q108: Maria and Christopher each own 50% of

Q177: Flapp Corporation, a U.S. corporation, conducts all