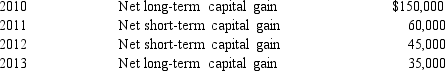

Carrot Corporation, a C corporation, has a net short-term capital gain of $65,000 and a net long-term capital loss of $250,000 during 2014. Carrot Corporation had taxable income from other sources of $720,000. Prior years' transactions included the following:

Compute the amount of Carrot's capital loss carryover to 2015.

Compute the amount of Carrot's capital loss carryover to 2015.

a. $0

b. $32,000

c. $45,000

d. $185,000

e. None of the above

Definitions:

Menstrual Cycle

The monthly series of changes a woman's body goes through in preparation for the possibility of pregnancy.

Irritability

A state of increased sensitivity or reactivity to stimuli, often resulting in negative emotional responses.

Delta Waves

Slow brain waves that are associated with deep sleep and aid in healing and regeneration.

NREM Sleep

Non-Rapid Eye Movement sleep, which is characterized by slower brain waves and is divided into three stages, representing a deeper level of sleep as one progresses from stage 1 to stage 3.

Q5: Refer to Exhibit 9-2.What dollar amount of

Q9: Refer to Exhibit 9-1.What will accounts payable

Q28: During Benson Company's most recent fiscal year,beginning

Q40: Marker Corporation manufactures and sells birdhouses and

Q44: The amount of cash paid out for

Q49: A taxpayer transfers assets and liabilities to

Q49: Thomas Inc.has two independent investment opportunities,each requiring

Q51: A negative ACE adjustment is beneficial to

Q51: All of the following are measures used

Q84: When does a redemption qualify as a