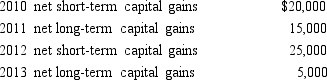

Ostrich, a C corporation, has a net short-term capital gain of $20,000 and a net long-term capital loss of $90,000 during 2014. Ostrich also has taxable income from other sources of $1 million. Prior years' transactions included the following:

a. How are the capital gains and losses treated on Ostrich's 2014 tax return?

b. Determine the amount of the 2014 net capital loss that is carried back to each of the previous years.

c. Compute the amount of capital loss carryover, if any, and indicate the years to which the loss may be carried.

d. If Ostrich were a proprietorship, how would Ellen, the owner, report these transactions on her 2014 tax return?

Definitions:

BIRGing

"Basking in Reflected Glory," a behavior where individuals associate themselves with successful others to improve their own self-esteem.

Self-Schematic

Relating to or concerning the cognitive aspects that represent how individuals perceive themselves in different contexts.

Dimensions

Measurable features that define or differentiate objects, concepts, or conditions along various axes like size, time, or scope.

Extreme

Positions, opinions, or actions that are far removed from the ordinary or moderate; often implying a significant deviation from the norm.

Q34: Refer to Exhibit 12-3.Which of these would

Q43: Prado Company applies fixed manufacturing overhead costs

Q43: What is a constructive dividend? Provide several

Q48: The bottom of the statement of cash

Q49: All of the following appear on the

Q49: Which court decision is generally more authoritative?<br>A)

Q52: The term decentralized organization refers to an

Q61: Ira, a calendar year taxpayer, purchases as

Q61: Longer class lives for depreciable property and

Q94: Which of the following items will be