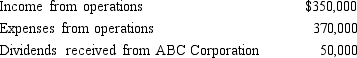

During the current year, Quartz Corporation (a calendar year C corporation) has the following transactions:

Quartz owns 25% of ABC Corporation's stock. How much is Quartz Corporation's taxable income (loss) for the year?

Quartz owns 25% of ABC Corporation's stock. How much is Quartz Corporation's taxable income (loss) for the year?

Definitions:

Irrevocable

Something that cannot be changed, reversed, or taken back once it has been established or done.

Grantor

The individual or entity that establishes a trust, transfers property, or conveys rights to another person or entity.

Spendthrift Trust

A trust designed to provide financial support to a beneficiary while protecting the trust assets from the beneficiary's creditors or from being spent recklessly by the beneficiary.

Creditors

Individuals or entities to whom money is owed by a debtor or the company.

Q3: Avoidable costs are as also called differential

Q6: Assume you receive $15,000 in four years

Q21: Refer to Exhibit 11-5.After the EVA adjustments

Q38: Purple Corporation has two equal shareholders, Joshua

Q44: Canary Corporation has 5,000 shares of stock

Q51: The domestic production activities deduction is structured

Q63: Which of the following statements is incorrect

Q83: Gold Corporation has accumulated E & P

Q101: Charitable contribution carryforward deducted in the current

Q106: State income tax paid in the current