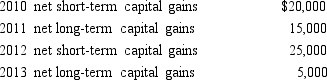

Ostrich, a C corporation, has a net short-term capital gain of $20,000 and a net long-term capital loss of $90,000 during 2014. Ostrich also has taxable income from other sources of $1 million. Prior years' transactions included the following:

a. How are the capital gains and losses treated on Ostrich's 2014 tax return?

b. Determine the amount of the 2014 net capital loss that is carried back to each of the previous years.

c. Compute the amount of capital loss carryover, if any, and indicate the years to which the loss may be carried.

d. If Ostrich were a proprietorship, how would Ellen, the owner, report these transactions on her 2014 tax return?

Definitions:

Commit

To pledge or bind oneself to a certain course or policy, especially in a business or professional setting.

Penalty Kick

A method of restarting play in soccer, awarded for a foul within the penalty area, taken from the penalty spot against only the goalkeeper.

Kicker's Payoffs

A rephrased definition: The potential returns or outcomes that a participant in a game or negotiation, known as the "kicker," stands to gain.

Probability of Success

The likelihood of a particular outcome deemed favorable or meeting a set goal.

Q11: Lockwood Company would like to purchase a

Q21: A corporation must file a Federal income

Q24: Fireside Inc.had sales as follows during 2012:<br><img

Q25: Which provision could best be justified as

Q25: Nondeductible meal and entertainment expenses must be

Q27: Sweet Corporation, a new corporation, has gross

Q28: The AMT exemption amount of $40,000 phases

Q45: Solutions Inc.would like to purchase a new

Q99: Briefly define the term "earnings and profits."

Q110: Property distributed by a corporation as a