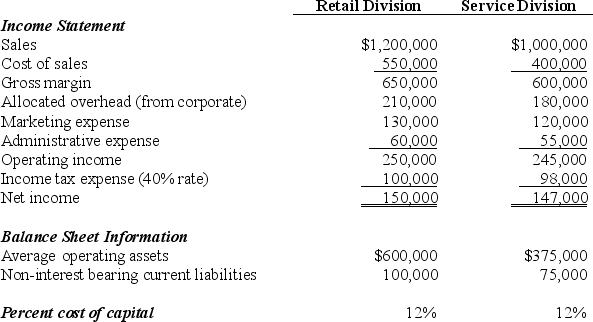

Becky's Bikes Inc.has two divisions: Retail and Service.The following information is for each division at Becky's Bikes for the most recent fiscal year.

To calculate EVA,management requires adjustments for marketing and non-interest bearing current liabilities as outlined below.

Marketing will be capitalized and amortized over several years resulting in an increase to average operating assets of $50,000 for the Retail division and $32,500 for the Services division.On the income statement,marketing expense for the year will be added back to operating income,then marketing amortization expense for one year will be deducted.The current year amortization expense will total $30,000 for the Retail division and $20,000 for the Services division.

Non-interest bearing liabilities will be deducted from average operating assets.

Calculate economic value added (EVA)for each division and comment on your results.

Definitions:

Rhomboideus Group

A set of muscles in the upper back that connect the spine to the scapula, aiding in shoulder movement and stability.

Intercostal Group

Muscles located between the ribs that assist with the breathing process by aiding in the expansion and contraction of the chest cavity.

Spinotrapezius

A back muscle that assists in moving the scapula for the lifting of the arm.

Masseter

A facial muscle that plays a major role in the chewing of food by raising the lower jaw towards the upper jaw.

Q1: A bike repair shop would most likely

Q9: Cambridge Products manufactures and sells cat toys

Q17: Starline Inc.manufactures and sells commercial coffee makers

Q22: All managers require one standard format for

Q40: In which of the following cases is

Q45: What are the tax consequences if an

Q47: Refer to Exhibit 5-7.Which of the following

Q48: Total costs at the low point were

Q50: In the case of corporations that are

Q103: Schedule M-1 of Form 1120 is used