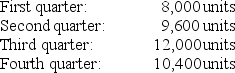

Cathy's Cookies produces cookies for resale at local grocery stores.The company is currently in the process of establishing a master budget on a quarterly basis for this coming fiscal year,which ends December 31.Prior year quarterly sales were as follows (1 unit = 1 batch):

Unit sales are expected to increase 20 percent,and each unit is expected to sell for $5.Management prefers to maintain ending finished goods inventory equal to 15 percent of next quarter's sales.Assume finished goods inventory at the end of the fourth quarter budget period is estimated to be 2,000 units.

(1)Prepare a sales budget for Cathy's Cookies.

(2)Prepare a production budget for Cathy's Cookies.

Definitions:

Average Cost Method

An inventory costing method that calculates the cost of goods sold based on the average cost of all similar items in inventory.

Equivalent Unit

A measure used in cost accounting to express the amount of work done by manufacturers on units that are partially completed at the end of an accounting period.

Applied Overhead

The portion of overhead costs allocated to specific jobs or departments based on a predetermined rate.

Department 2

A designated segment within an organization, often used in context to differentiate varying functional areas or operational units.

Q6: Douglas and Sue, related parties, are landlord

Q10: Capri Incorporated has annual fixed costs totaling

Q20: All of the following are steps of

Q33: Which of the following best describes an

Q34: Only one judge hears a trial in

Q36: Underapplied overhead occurs when actual overhead costs

Q50: All of the following can be performed

Q52: Albany Company has net income before taxes

Q54: The budgeted balance sheet shows an estimate

Q84: Which of the following statements is incorrect