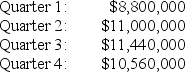

Marker Products Inc sells all of its products on credit.The company expects to collect 65 percent of sales in the quarter of sale and 35 percent the quarter following the sale.Accounts receivable at the end of last year totaled $3 million,all of which will be collected in the first quarter of the coming year.Marker's sales budget shows the following projected sales revenues:

Prepare a budget for cash collections from sales for each of the four quarters.

Definitions:

Taxation

The process by which governments impose charges on citizens and corporate entities to fund public expenditures and services.

Jean Baptiste Colbert

was a French politician who served as the Minister of Finances of France under King Louis XIV, known for his policies aimed at strengthening the French economy through mercantilism.

Federal Tax

A tax levied by the federal government on income, corporate profits, and other aspects of the financial activity within a country.

Cigarettes

are small cylinders of finely cut tobacco leaves rolled in thin paper for smoking, often containing chemical additives.

Q1: All of the following items can appear

Q11: Both process costing and job costing typically

Q33: Juanita owns 60% of the stock in

Q34: The break-even point is the number of

Q40: Refer to Exhibit 11-5.After the EVA adjustments

Q57: All of the following appear on the

Q65: If these citations appeared after a trial

Q66: Canary Corporation, an accrual method C corporation,

Q66: Refer to Exhibit 9-2.What will accounts receivable

Q67: Activity-based costing breaks total estimated overhead costs