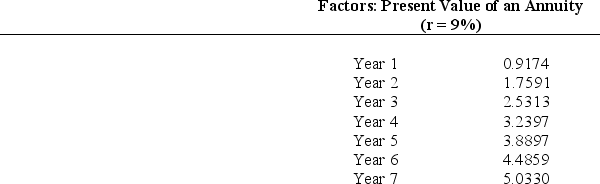

Niwot Inc.is considering an investment that will generate $600,000 in cash inflows per year for 7 years and has $360,000 of cash outflows for the same period (before income taxes) .The cost of the asset is $420,000 and it will be depreciated using straight-line depreciation over the 7 year life.The asset has no salvage value.Niwot's tax rate is 30%.The cost of capital is 9%.

What is the net present value of this investment (rounded to the nearest dollar) ?

Definitions:

Average Annual Return

The compound annual growth rate of an investment over a specified period of time.

Fama and French

A multifactored model developed by Eugene Fama and Kenneth French to describe stock returns, incorporating market, size, and value factors among others.

Efficient-Market Hypothesis

A theory that suggests that financial markets fully absorb and reflect all available information, making it impossible to consistently achieve higher returns than the market average.

Small Investor

An individual investor who makes relatively small amounts of investments in the stock market or other financial markets, often with limited resources.

Q7: Refer to Exhibit 7-5.Based on this information,which

Q12: All of the following are false about

Q14: Randle Company ran a regression analysis comparing

Q16: Refer to Exhibit 7-1.When the incremental revenues

Q17: Refer to Exhibit 6-2.What would be the

Q27: Refer to Exhibit 6-4.Assume the sales mix

Q38: If a processing department has no beginning

Q38: All of the following statements are false

Q49: The Securities and Exchange Commission (SEC)does not

Q57: Colfax Company incurred production labor costs of