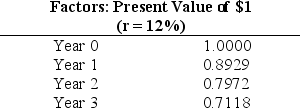

Rambus Inc.would like to purchase a production machine for $325,000.The machine is expected to have a life of three years,and a salvage value of $50,000.Annual maintenance costs will total $12,500.Annual savings are predicted to be $112,500.The company's required rate of return is 12 percent.

(1)Using the Present Value Factors for $1,calculate the net present value of this investment (ignoring taxes).

(2)Based on your answer in requirement 1,should Rambus purchase the production machine?

Definitions:

Uniform Commercial Code

A standardized collection of laws and regulations for the conduct of business transactions and the sale of goods across the United States.

Good Faith

An honest intention to act without taking an unfair advantage over another person.

Wrongful Rejection

The unjustified refusal of a buyer to accept goods or services as stipulated in a contract.

Good Faith

The genuine intention to act without taking an unfair advantage over another party in a transaction.

Q7: Eaton Company uses activity-based costing to allocate

Q11: Heron Corporation, a calendar year, accrual basis

Q13: Refer to Exhibit 6-2.What would be the

Q14: Belden Company has a profit margin ratio

Q17: Lanyard Company is considering an investment that

Q41: All of the following are steps used

Q43: Refer to Exhibit 7-9.If the sales value

Q45: Only information from the income statement is

Q63: Which of the following costs is typically

Q66: Refer to Exhibit 7-9.If the sales value