Multiple Choice

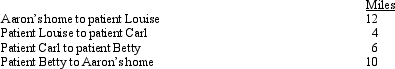

Aaron is a self-employed practical nurse who works out of his home.He provides nursing care for disabled persons living in their residences.During the day he drives his car as follows.  Aaron's deductible mileage for each workday is:

Aaron's deductible mileage for each workday is:

Definitions:

Related Questions

Q11: The income of a sole proprietorship are

Q15: Larry, a calendar year cash basis taxpayer,

Q18: Beige, Inc., an airline manufacturer, is conducting

Q23: Several years ago, John purchased 2,000 shares

Q24: Regression analysis and the high-low method often

Q44: The portion of property tax on a

Q73: Workers' compensation benefits are included in gross

Q74: Hazel purchased a new business asset (five-year

Q92: Jackson gives his supervisor a $30 box

Q98: Debby is a self-employed accountant with a