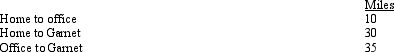

Amy works as an auditor for a large major CPA firm.During the months of September through November of each year, she is permanently assigned to the team auditing Garnet Corporation.As a result, every day she drives from her home to Garnet and returns home after work.Mileage is as follows:  For these three months, Amy's deductible mileage for each workday is:

For these three months, Amy's deductible mileage for each workday is:

Definitions:

Interest Rate

The percentage of a loan amount charged by a lender to a borrower for the use of assets, which can vary based on factors like inflation, the time value of money, and the risk involved.

Loanable Funds

The market where savers supply funds to borrowers, typically through financial intermediaries.

Quantity Supplied

The total amount of a specific good or service that producers are willing and able to sell at a given price, during a certain time period.

Pension Program

A financial arrangement designed to provide individuals with an income when they are no longer earning a regular income from employment.

Q1: Which of the following companies would most

Q6: Fresh Bakery often has unsold donuts at

Q15: Refer to Exhibit 5-6.Assume Barton Industries will

Q53: Refer to Exhibit 5-6.Using the information above,what

Q55: Barry purchased a used business asset (seven-year

Q55: For tax years beginning in 2012, the

Q61: In 2012, Theo, an employee, had a

Q79: Identify the factors that should be considered

Q129: The legal cost of having a will

Q136: At age 65, Camilla retires from her