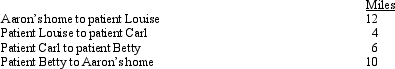

Aaron is a self-employed practical nurse who works out of his home.He provides nursing care for disabled persons living in their residences.During the day he drives his car as follows.  Aaron's deductible mileage for each workday is:

Aaron's deductible mileage for each workday is:

Definitions:

New York Times v. United States

A landmark Supreme Court case in 1971 that made it possible for the New York Times and Washington Post newspapers to publish the then-classified Pentagon Papers without risk of government censorship or punishment.

Prior Publication

Prior Publication refers to work that has been previously published or made publicly available before the submission of a current work, often affecting the novelty or copyright eligibility of the latter.

Branzburg v. Hayes

A Supreme Court case that held reporters do not have a First Amendment privilege to refuse to provide evidence to grand juries.

Fighting Words

Phrases or expressions that by their utterance can inflict injury or incite an immediate breach of peace.

Q8: What losses are deductible by an individual

Q10: Before purchasing an Enterprise Resource Planning (ERP)system,companies

Q13: Regression analysis is one of the most

Q35: Manufacturing overhead consists of all costs related

Q37: Sam was unemployed for the first two

Q47: Refer to Exhibit 6-4.Assume the sales mix

Q65: You are trying to decide whether to

Q72: The amount of partial worthlessness on a

Q135: Mitch is in the 28% tax bracket.

Q149: Describe the circumstances under which a taxpayer