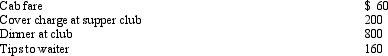

Henry entertains several of his key clients on January 1 of the current year.Expenses paid by Henry are as follows:  Presuming proper substantiation, Henry's deduction is:

Presuming proper substantiation, Henry's deduction is:

Definitions:

Internal Customers

Individuals or departments within an organization that rely on the support or services of other parts of the organization to fulfill their roles and responsibilities.

External Customers

Individuals or entities outside of an organization that receive or consume the products or services offered by the organization.

Dependent Employees

Employees who rely on their employers for work direction and income, typically having less autonomy in their roles compared to independent contractors or freelancers.

Symbolic Leader

Uses symbols to establish and maintain a desired organisational culture.

Q6: Under the alternative depreciation system (ADS), the

Q8: Refer to Exhibit 5-2.What are the estimated

Q16: According to the IMA Statement of Ethical

Q25: All of the following are ways that

Q33: If a taxpayer has an NOL in

Q42: For a vacation home to be classified

Q80: Martha rents part of her personal residence

Q86: The IRS will not issue advanced rulings

Q87: Five years ago, Tom loaned his son

Q94: Petal, Inc.is an accrual basis taxpayer.Petal uses