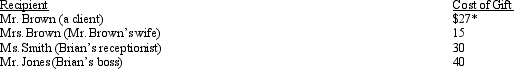

Brian makes gifts as follows:

* Includes $2 for engraving

* Includes $2 for engraving

Presuming adequate substantiation and no reimbursement, how much may Brian deduct?

Definitions:

Amortization

The process of gradually writing off the initial cost of an asset over its useful life.

Bond Investment

An investment in debt securities issued by corporations or governments to finance their operations.

Other Comprehensive Income

Other Comprehensive Income represents revenues, expenses, gains, and losses not included in net income, and reflects changes in equity during a period except those resulting from investments by and distributions to owners.

Q23: All of the following are examples of

Q52: Orange Corporation begins business on April 2,

Q54: Tired of renting, Dr.Smith buys the academic

Q56: Tom acquired a used five-year class asset

Q59: For an expense to be deducted as

Q63: On May 15, 2012, Brent purchased new

Q67: Ron, age 19, is a full-time graduate

Q90: Cream, Inc.'s taxable income for 2012 before

Q92: Jackson gives his supervisor a $30 box

Q143: Carolyn is single and has a college