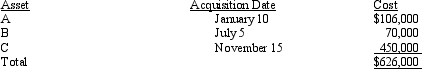

Audra acquires the following new five-year class property in 2012:

Audra elects § 179 for Asset

Audra elects § 179 for Asset

C.Audra's taxable income from her business would not create a limitation for purposes of the § 179 deduction. Audra takes additional first-year depreciation.Determine her total cost recovery deduction (including the § 179 deduction) for the year.

Definitions:

Investment Account

An account held at a financial institution that is used to buy and hold various investment assets, like stocks, bonds, mutual funds, and ETFs, often used for long-term financial goals.

Equity Method

An accounting technique used to record the investments made in other companies, reflecting the investor's proportional share of the investee's net income or loss.

Undervalued Inventory

Undervalued inventory occurs when the recorded cost of inventory is less than its current market value, potentially misstating a company's financial position.

Carrying Value

The book value of an asset or liability on a company's balance sheet, calculated as the original cost minus accumulated depreciation or amortization.

Q3: Which of the following assets would be

Q9: Emelie and Taylor are employed by the

Q13: After the divorce, Jeff was required to

Q24: It is acceptable to allocate selling costs

Q32: Briefly discuss the disallowance of deductions for

Q37: Roseville Engineering provides watershed and design services

Q57: The cost of legal advice associated with

Q57: The amount of a farming loss cannot

Q90: Mother participated in a qualified state tuition

Q96: If a business debt previously deducted as