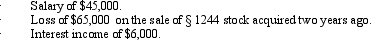

John files a return as a single taxpayer.In 2012, he had the following items:  Determine John's AGI for 2012.

Determine John's AGI for 2012.

Definitions:

Budgeted Net Income

The projected net income for a future period, based on expected revenues and expenses.

Variable Expenses

Expenses directly linked to the volume of output, adjusting in accordance with business activity levels.

Fixed Expenses

Recurring costs that do not vary with the level of production or sales, such as rent, salaries, and insurance.

Degree of Operating Leverage

A financial ratio that measures the sensitivity of a company's operating income to a change in its sales volume, signifying the impact of fixed versus variable costs.

Q10: Before purchasing an Enterprise Resource Planning (ERP)system,companies

Q40: Specialty Chocolates recently expanded its operations beyond

Q47: When contributions are made to a Roth

Q52: Thelma and Mitch were divorced.The couple had

Q53: Swan Finance Company, an accrual method taxpayer,

Q76: Which of the following statements about computerized

Q76: What are the three methods of handling

Q77: Judy is a cash basis attorney.In 2012,

Q77: Any pre-tax amount elected by an employee

Q134: For an activity classified as a hobby,