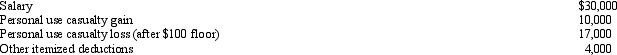

In 2012, Mary had the following items:  Assuming that Mary files as head of household (has one dependent child) , determine her taxable income for the current year.

Assuming that Mary files as head of household (has one dependent child) , determine her taxable income for the current year.

Definitions:

Net Income

The total profit of a company after all expenses, taxes, and costs have been subtracted from total revenue, indicating the company's financial performance over a period.

Consolidation Entry TI

A specific type of journal entry made during the consolidation process to integrate the financial activities of a parent company and its subsidiaries.

Consolidation Entry G

An accounting entry used in consolidation to eliminate the effects of intercompany transactions among entities within a consolidated group for external reporting.

Wholly Owned Subsidiary

A company whose entire share capital is held by another company, making it a completely controlled entity of the parent company.

Q32: For a company using activity-based management, identify

Q32: The inventory cost flow equation is:<br>A)Beginning balance

Q36: In 2012, Hal furnishes more than half

Q37: When comparing the characteristics of financial and

Q44: Which of the following statements best describes

Q50: All of the following can be performed

Q66: Ted earned $150,000 during the current year.He

Q87: Under the Federal income tax formula for

Q107: Betty purchased an annuity for $24,000 in

Q141: Two-thirds of treble damage payments under the