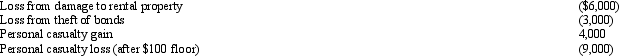

In 2012, Morley, a single taxpayer, had an AGI of $30,000 before considering the following items:  Determine the amount of Morley's itemized deduction from the losses.

Determine the amount of Morley's itemized deduction from the losses.

Definitions:

Mutual Mistake

A legal doctrine where both parties entering into a contract have an incorrect belief about an important fact, potentially rendering the contract voidable.

Unilateral Mistake

A legal concept wherein one party to a contract is mistaken about a fundamental fact or term of the agreement.

Subsurface Soil Condition

Refers to the properties and characteristics of the soil beneath the surface, important for construction and agricultural activities.

Voidable

A term referring to a valid agreement that may be legally declared invalid by one of the parties.

Q10: During the year, Peggy went from Nashville

Q42: Sharon had some insider information about a

Q43: Under the terms of a divorce agreement,

Q66: If an automobile is placed in service

Q83: When lessor owned leasehold improvements are abandoned

Q91: Gull Corporation was undergoing reorganization under the

Q91: At the beginning of 2013, Mary purchased

Q96: Are there any exceptions to the rule

Q109: Which of the following must be capitalized

Q149: For the current football season, Tern Corporation