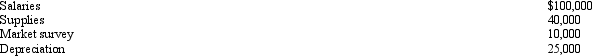

In 2011, Robin Corporation incurred the following expenditures in connection with the development of a new product:

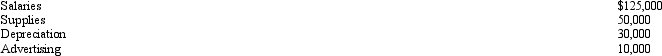

In 2012, Robin incurred the following additional expenditures in connection with the development of the product:

In 2012, Robin incurred the following additional expenditures in connection with the development of the product:

In October 2012, Robin began receiving benefits from the project.If Robin elects to expense research and experimental expenditures, determine the amount and year of the deduction.

In October 2012, Robin began receiving benefits from the project.If Robin elects to expense research and experimental expenditures, determine the amount and year of the deduction.

Definitions:

T-Bill

Short for Treasury Bill, this is a short-term government security issued at a discount from par value and pays no interest.

Risk Tolerance

The degree of variability in investment returns that an investor is willing to withstand, related to one's financial situation, investment objectives, and psychological comfort.

Risky Asset

An asset that carries a significant degree of risk of losing value, but also offers a potential for higher returns compared to safer investments.

Risk-Free Asset

An asset which is assumed to provide a guaranteed return with negligible risk of financial loss, often considered to be short-term government securities.

Q5: Tonya is a cash basis taxpayer.In 2012,

Q25: Ed is divorced and maintains a home

Q26: In 2012, Wally had the following insured

Q31: An analysis comparing actual labor hours used

Q34: Which of the following expenses, if any,

Q41: On February 20, 2012, Susan paid $200,000

Q64: Under the alimony rules:<br>A)The income is included

Q77: Tan Company acquires a new machine (ten-year

Q89: Determine the proper tax year for gross

Q109: Which of the following must be capitalized