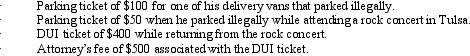

Andrew, who operates a laundry business, incurred the following expenses during the year.  What amount can Andrew deduct for these expenses?

What amount can Andrew deduct for these expenses?

Definitions:

Hobby

An activity done regularly in one's leisure time for pleasure, which might generate income that is treated differently for tax purposes than income earned from a business.

Income Connected

Relates to earnings or revenue that is directly related to a specific source or activity, often used in legal or tax contexts.

Standard Mileage Rate

A set rate per mile set by the IRS that taxpayers can use to calculate deductions for the business use of a vehicle.

Business Deduction

Expenses incurred in the operation of a business that can be subtracted from its income to reduce the taxable income.

Q24: In terms of the tax formula applicable

Q42: Donna, age 27 and unmarried, is an

Q46: Juan, was considering purchasing an interest in

Q66: If an automobile is placed in service

Q85: Taxable income for purposes of § 179

Q86: The IRS will not issue advanced rulings

Q90: In December 2012, Mary collected the December

Q91: At the beginning of 2013, Mary purchased

Q95: On January 15, 2012, Vern purchased the

Q119: When using the automatic mileage method, which,