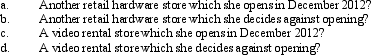

Gladys owns a retail hardware store in Tangipahoa.She is considering opening a business in Hammond, a community located 25 miles away.She incurs expenses of $60,000 in 2012 in investigating the feasibility and desirability of doing so.What amount can Gladys deduct in 2012 if the business is:

Definitions:

Older Infants

Infants typically between the ages of 9 to 12 months who are developing new skills such as crawling, standing, or beginning to walk.

Habituate

The process of becoming accustomed to a stimulus over time, leading to a decrease in one's response to that stimulus.

Infant Categorization

The process by which infants organize information by grouping objects, events, or people based on common features, aiding in their understanding of the world.

Social Referencing

The process by which individuals look to others in an environment to obtain cues for appropriate behavior or attitudes.

Q19: Contributions to a Roth IRA can be

Q30: A U.S.citizen worked in a foreign country

Q42: How is qualified production activities income (QPAI)

Q44: During the past two years, through extensive

Q47: Discuss the difference between the half-year convention

Q85: Taxable income for purposes of § 179

Q98: Sharon made a $60,000 interest-free loan to

Q125: Surviving spouse filing status begins in the

Q140: Arnold is married to Sybil, who abandoned

Q148: The stock of Eagle, Inc.is owned as