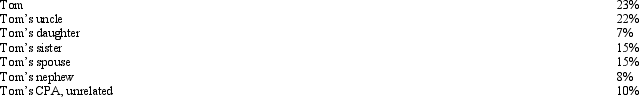

The stock of Eagle, Inc.is owned as follows:

Tom sells land and a building to Eagle, Inc.for $212,000.His adjusted basis for these assets is $225,000.Calculate Tom's realized and recognized loss associated with the sale.

Tom sells land and a building to Eagle, Inc.for $212,000.His adjusted basis for these assets is $225,000.Calculate Tom's realized and recognized loss associated with the sale.

Definitions:

Financial Institutions

Organizations that provide financial services, such as banks, insurance companies, and investment firms.

Chapter 11

A provision under the U.S. Bankruptcy Code that allows for business reorganization under court supervision while maintaining operations.

Chapter 7

A provision under the U.S. Bankruptcy Code allowing individuals or businesses to liquidate their assets to pay off creditors as part of a bankruptcy proceeding.

Railroads

Railroads are companies that operate trains on a set of tracks for the transport of goods and passengers.

Q2: The Purple & Gold Gym, Inc., uses

Q19: Contributions to a Roth IRA can be

Q58: The Perfection Tax Service gives employees $12.50

Q66: If an automobile is placed in service

Q85: A sole proprietorship purchased an asset for

Q87: Austin, a single individual with a salary

Q92: Derek, age 46, is a surviving spouse.If

Q110: For purposes of determining gross income, which

Q115: Teal company is an accrual basis taxpayer.On

Q142: After Carolyn moves out of the apartment