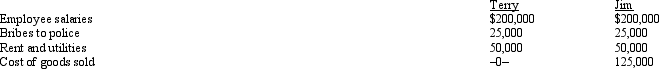

Terry and Jim are both involved in operating illegal businesses.Terry operates a gambling business and Jim operates a drug running business.Both businesses have gross revenues of $500,000.The businesses incur the following expenses.  Which of the following statements is correct?

Which of the following statements is correct?

Definitions:

Internal Supply

The availability of existing employees who can be promoted, transferred, or otherwise moved to fill open positions within an organization.

Markov Analysis

A statistical technique that uses probabilities to predict future states in a system based on its current state, often used for decision making and forecasting.

Human Resources Supply

The availability of potential employees, both within and outside the organization, who possess the skills and qualifications to meet its labor needs.

Demand

The desire and ability of purchasers to buy goods and services at different prices.

Q4: All of the following are included in

Q6: Under the alternative depreciation system (ADS), the

Q11: Howard, age 82, dies on January 2,

Q52: Jayden and Chloe Harper are husband and

Q74: Hazel purchased a new business asset (five-year

Q81: Robyn rents her beach house for 60

Q103: When separate income tax returns are filed

Q123: Velma and Josh divorced. Velma's attorney fee

Q145: A hobby activity can result in all

Q149: Describe the circumstances under which a taxpayer