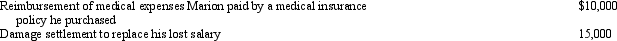

Early in the year, Marion was in an automobile accident during the course of his employment.As a result of the physical injuries he sustained, he received the following payments during the year:  What is the amount that Marion must include in gross income for the current year?

What is the amount that Marion must include in gross income for the current year?

Definitions:

Involuntary Manslaughter

The unintentional killing of a person due to reckless or careless actions, without the intent to cause death.

Negligence

Guilty of neglect; lacking in due care or concern; act of carelessness.

Federal Law

Legislation enacted by Congress and signed by the president.

Legislation

Laws that have been passed by a governing body or the process of making or enacting laws.

Q29: Deductions for AGI are often referred to

Q58: Nicole just retired as a partner in

Q74: If the alimony recapture rules apply, the

Q75: Linda delivers pizzas for a pizza shop.On

Q77: Judy is a cash basis attorney.In 2012,

Q101: Which of the following taxpayers use a

Q103: When separate income tax returns are filed

Q118: A gift to charity from its 2012

Q126: Legal expenses incurred in connection with rental

Q132: If a vacation home is classified as