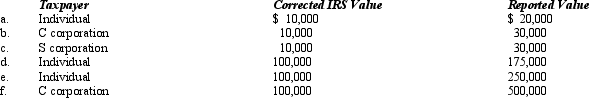

Compute the overvaluation penalty for each of the following independent cases involving the taxpayer's reporting of the fair market value of charitable contribution property.In each case, assume a marginal income tax rate of 35%.

Definitions:

Consumption

The use of goods and services by households for personal needs or the process of using up resources or goods, leading to a decrease in their availability.

Investment Incentives

Investment incentives are benefits or policies designed to encourage businesses or individuals to invest in certain areas or sectors.

Interest Rate

Lenders require a payment, portrayed as a percentage of the principal, from borrowers for the use of their assets.

Loanable Funds

The market where savers supply funds for loans to borrowers, often facilitated by financial institutions, impacting the interest rates and investment in the economy.

Q34: The tax _ workpapers are not privileged

Q63: The Prakash Estate is required to pay

Q91: To file for a tax refund, an

Q100: Faye, a CPA, is preparing Judith's tax

Q102: Which of the following statements correctly reflects

Q102: When the kiddie tax applies, the child

Q117: An individual is not subject to an

Q138: In determining the filing requirement based on

Q140: Arnold is married to Sybil, who abandoned

Q150: An increase in a taxpayer's AGI will