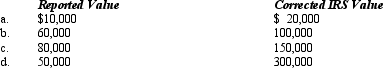

Compute the undervaluation penalty for each of the following independent cases involving the executor's reporting of the value of a closely held business in the decedent's gross estate.In each case, assume a marginal estate tax rate of 45%.

Definitions:

Gross Method

An accounting practice where discounts for prompt payments are not deducted from invoice amounts unless a payment is made within the discount period.

Vouchers Payable

Obligations or debts owed by a company for goods and services that have been received but not yet paid for.

Purchases Discount

A reduction in the price paid for goods, given for early payment according to the terms of purchase.

Voucher Register

A record-keeping system that logs all vouchers issued and paid by a business, detailing payments to suppliers and services.

Q63: Since an abandoned spouse is treated as

Q66: The Martins have a teenage son who

Q79: An exempt entity in no circumstance is

Q98: Last year, Ned's property tax deduction on

Q109: The AICPA's Statements on Standards for Tax

Q113: Match the following statements.<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4135/.jpg" alt="Match

Q133: A use tax applies when a State

Q137: An individual taxpayer uses a fiscal year

Q141: Typically exempt from the sales/use tax base

Q142: A negligence penalty is assessed when the