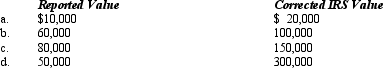

Compute the undervaluation penalty for each of the following independent cases involving the executor's reporting of the value of a closely held business in the decedent's gross estate.In each case, assume a marginal estate tax rate of 45%.

Definitions:

Flexible Sick-time

Policies that allow employees discretion in how they use their allotted time off for health-related issues.

Portable Benefits

Employee benefits that can be retained and transferred between different jobs or employment statuses.

Mobile Work Force

Employees who are equipped to work from various locations outside of a traditional office setting, facilitated by technology.

Recent Years

A term referring to the very latest past period, often without specifying the exact duration.

Q30: Gains on the sale of U.S.real property

Q31: Married taxpayers who file a joint return

Q43: The IRS can use § 482 reallocations

Q58: Millie, age 80, is supported during the

Q59: The basic and additional standard deductions are

Q77: A tax haven often is:<br>A)A country with

Q78: Nice, Inc., a § 501(c)(3) organization, inherited

Q80: Kurt Corporation realized $900,000 taxable income from

Q91: A U.S.corporation may be able to alleviate

Q111: No maximum or minimum dollar sales or