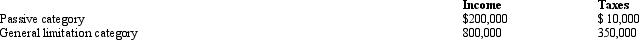

Britta, Inc., a U.S.corporation, reports foreign-source income and pays foreign taxes as follows.

Britta's worldwide taxable income is $1,600,000 and U.S.taxes before FTC are $560,000 (assume a 35% tax rate).What is Britta's U.S.tax liability after the FTC?

Britta's worldwide taxable income is $1,600,000 and U.S.taxes before FTC are $560,000 (assume a 35% tax rate).What is Britta's U.S.tax liability after the FTC?

Definitions:

Good Faith

Conduct characterized by honesty, integrity, and sincerity, especially in fulfilling contracts or negotiations.

Expense Report

A document that itemizes and records all the costs incurred during a business operation or trip.

Personal Entertainment

Forms of amusement or leisure activities that individuals engage in for enjoyment and relaxation.

Company Policy

A set of rules, guidelines, or principles established by an organization that governs its operations and employee behavior.

Q29: An S corporation's separately stated items are

Q29: Which of the following statements regarding the

Q48: Which of the following is not a

Q48: An exempt organization owns a building for

Q62: A taxpayer penalty may be waived if

Q62: When the Holloway Trust terminated this year,

Q66: The Martins have a teenage son who

Q80: Which of the following statements concerning the

Q139: During the current year, Doris received a

Q143: Pedro is married to Consuela, who lives