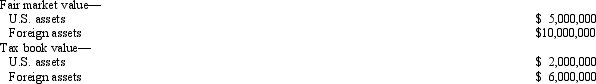

Qwan, a U.S.corporation, reports $250,000 interest expense for the tax year.None of the interest relates to nonrecourse debt or loans from affiliated corporations.Qwan's U.S.and foreign assets are reported as follows.  How should Qwan assign its interest expense between U.S.and foreign sources to maximize its FTC for the current year?

How should Qwan assign its interest expense between U.S.and foreign sources to maximize its FTC for the current year?

Definitions:

Reputation

The public perception or opinion of an individual, company, or product based on past actions or achievements.

Electronic Signatures in Global

Digital signatures recognized internationally, facilitating transactions and contracts over the Internet.

E-Signature Act

Legislation that gives electronic signatures the same legal standing as traditional handwritten signatures in contractual and legal documents.

National Commerce Act

Legislation that regulates online or electronic merchant transactions and electronic signatures.

Q16: If an exempt organization distributes "low-cost items"

Q36: After the completion of an audit, the

Q43: Acquisition indebtedness consists of the unpaid amounts

Q45: Garcia Corporation is subject to tax in

Q49: What method is used to allocate S

Q52: Jayden and Chloe Harper are husband and

Q57: Roger prepared for compensation a Federal income

Q62: When the Holloway Trust terminated this year,

Q96: A Qualified Business Unit of a U.S.corporation

Q99: Which of the following taxpayers may file