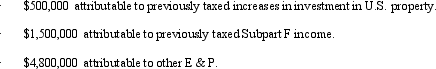

Xenia, Inc., a U.S.shareholder, owns 100% of Fredonia, a CFC.Xenia receives a $3 million cash distribution from Fredonia.Fredonia's E & P is composed of the following amounts.  Xenia recognizes a taxable dividend of:

Xenia recognizes a taxable dividend of:

Definitions:

Tropical Biome

A biome characterized by a warm climate year-round, significant rainfall, and a high level of biodiversity, typically located near the Equator.

Grasses

Plants belonging to the family Poaceae, characterized by narrow leaves growing from the base.

Savanna

Tropical biome dominated by grasses with a few scattered shrubs and trees.

Freshwater

Bodies of water that have a low concentration of salt, such as lakes, rivers, and streams, crucial for the survival of many ecosystems.

Q22: In computing the Federal taxable income of

Q37: Roughly five percent of all taxes paid

Q49: List at least three exceptions to the

Q59: Under P.L.86-272, which of the following transactions

Q80: Three weeks after Abed died, his brother

Q90: The League of Women Voters is a

Q111: Support the Pets, Inc., a § 501(c)(3)

Q121: When a tax issue is taken to

Q130: Tan, Inc., a tax-exempt organization, has $65,000

Q135: In conducting multistate tax planning, the taxpayer