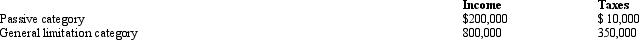

Britta, Inc., a U.S.corporation, reports foreign-source income and pays foreign taxes as follows.

Britta's worldwide taxable income is $1,600,000 and U.S.taxes before FTC are $560,000 (assume a 35% tax rate).What is Britta's U.S.tax liability after the FTC?

Britta's worldwide taxable income is $1,600,000 and U.S.taxes before FTC are $560,000 (assume a 35% tax rate).What is Britta's U.S.tax liability after the FTC?

Definitions:

Union Representative

A union representative is an individual elected or appointed to represent the interests of members in a labor union, often concerning labor rights, disputes, and negotiations.

Bullied

Bullied refers to someone who has been targeted repeatedly by individuals or groups through intimidation, physical harm, or other abusive behaviors, typically to assert power over the victim.

Family-Proof

Making an environment or item safe and suitable for all family members, often considering the needs and safety of children.

Reading Skills

The abilities involved in understanding, interpreting, and making meaning from written texts.

Q4: Unused foreign tax credits are carried back

Q51: One of the requirements for an exempt

Q86: When a business taxpayer "goes international," the

Q94: PaulCo, DavidCo, and Sean form a partnership

Q95: Any distribution made by an S corporation

Q116: Compute the failure to pay and failure

Q120: Most states waive the collection of sales

Q122: The Zhao Estate generated distributable net income

Q134: A calendar year C corporation reports a

Q144: The throwback rule requires that:<br>A)Sales of tangible