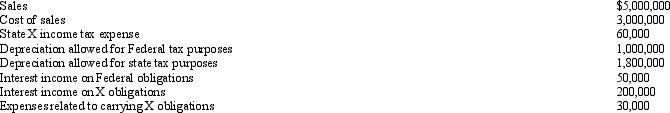

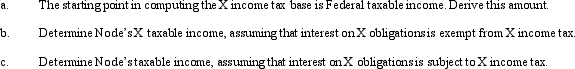

Node Corporation is subject to tax only in State X.Node generated the following income and deductions.State income taxes are not deductible for X income tax purposes.

Definitions:

Assets

Resources owned or controlled by a business from which future economic benefits are expected.

Net Income

The total profit of a company after all expenses, including taxes and operating costs, have been deducted from total revenue.

Depreciation

A method of allocating the cost of a tangible asset over its useful life, reflecting its consumption, wear and tear, or obsolescence.

Market Value

The existing cost for acquiring or selling an asset or service in the unrestricted market.

Q26: Carlos receives a proportionate liquidating distribution consisting

Q29: It is advisable that an IRS audit

Q45: Garcia Corporation is subject to tax in

Q53: State and local politicians tend to apply

Q61: In calculating unrelated business taxable income, the

Q65: GlobalCo, a foreign corporation not engaged in

Q81: If an S corporation has C corporate

Q103: Identify some state/local income tax issues facing

Q104: Rents always are considered to be passive

Q149: How may an S corporation manage its