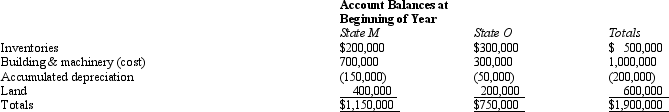

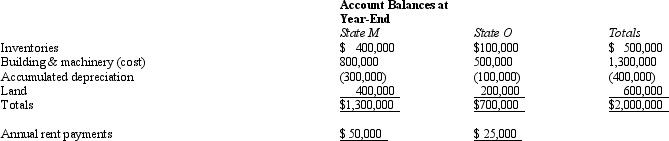

Bert Corporation, a calendar-year taxpayer, owns property in States M and O.Both M and O require that the average value of assets be included in the property factor.M requires that the property be valued at its historical cost, and O requires that the property be included in the property factor at its net depreciated book value.

Bert's M property factor is:

Bert's M property factor is:

Definitions:

Type II Error

The error that occurs when a false null hypothesis is not rejected, also known as a "false negative."

Reducing

The process of decreasing or minimizing a quantity, dimension, or frequency.

Type I Error

The incorrect rejection of a true null hypothesis, also known as a "false positive."

Type II Error

The error that occurs when a statistical test fails to reject a false null hypothesis (a "false negative").

Q13: An S corporation may be subject to

Q39: An estate operates a manufacturing business. It

Q40: The Willa estate reports $100,000 DNI, composed

Q45: There is no limit on the amount

Q77: Compost Corporation has finished its computation of

Q86: Which of the following activities is not

Q87: Goolsbee, Inc., a domestic corporation, generates U.S.-source

Q116: Compute the failure to pay and failure

Q126: Which of the following is not immune

Q136: A tax preparer is in violation of