Mercy Corporation, headquartered in F, sells wireless computer devices, including keyboards and bar code readers. Mercy's degree of operations is sufficient to establish nexus only in E and

F.Determine its sales factor in those states.

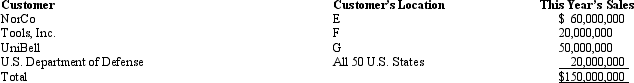

State E applies a throwback rule to sales, while State F does not.State G has not adopted an income tax to date.Mercy reported the following sales for the year.All of the goods were shipped from Mercy's F manufacturing facilities.

Because F has not adopted a throwback rule, the sales to customers in G and to the U.S.government are not included in either state's sales factor.Mercy creates $70 million in "nowhere sales."

E Sales factor = $60 million/$150 million = 40.00%

F Sales factor = $20 million/$150 million = 13.33%

Definitions:

Defence Mechanism

Psychological strategies brought into play by the unconscious mind to manipulate, deny, or distort reality in order to defend against feelings of anxiety and unacceptable impulses.

Interpersonal Attraction

The force that draws people together, leading to friendships, romantic relationships, or other social connections.

Mental Stress

The psychological strain or distress experienced by an individual in response to perceived pressures or challenges.

Heart Disease

A broad term for a range of conditions affecting the heart or blood vessels, often associated with atherosclerosis or heart function issues.

Q13: Waldo, Inc., a U.S.corporation, owns 100% of

Q15: The IRS processes about _ million individual

Q19: The use tax is designed to complement

Q19: Blue, Inc., receives its support from the

Q22: At the beginning of the year, Elsie's

Q41: By making a water's edge election, the

Q65: GlobalCo, a foreign corporation not engaged in

Q105: Match the definition with the correct term.Not

Q108: Beginning in 2012, Ewing, Inc., an S

Q131: Waltz, Inc., a U.S.taxpayer, pays foreign taxes