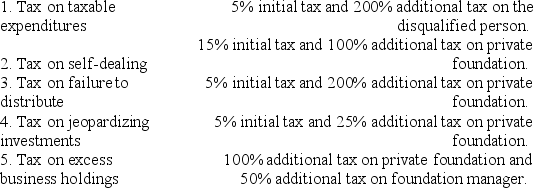

For each of the following taxes which are imposed on private foundations, match the appropriate initial tax or additional tax.

Definitions:

Test-Retest Reliability

The consistency of a measure evaluated over time, ensuring that the same results are achieved under the same conditions on subsequent administrations.

Personality Theories

The study of the development, structure, and dynamics of personality.

Manifests Itself

Refers to the way something becomes apparent or is shown in actions or symptoms.

B. F. Skinner

An American psychologist known for his work in behaviorism and the development of the theory of operant conditioning.

Q3: Compare the distribution of property rules for

Q12: Harry and Sally are considering forming a

Q20: A taxpayer must pay any tax deficiency

Q21: Claude Bergeron sold 1,000 shares of Ditta,

Q35: A distribution cannot be "proportionate" if only

Q86: On December 31, 2011, Erica Sumners owns

Q86: Rebecca is a limited partner in the

Q95: Any distribution made by an S corporation

Q107: Jake, an individual calendar year taxpayer, incurred

Q116: With respect to passive losses, there are