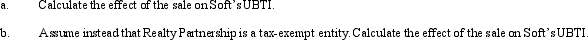

Soft, Inc., a § 501(c)(3) organization, has been leasing a building to Ice, Inc., a taxable entity, for 12 years.The lease terminates in the current tax year.Soft's adjusted basis for the building is $350,000.It sells the building to the Realty Partnership, a taxable entity, for $625,000.Selling expenses are $37,500.

Definitions:

Photic

Pertaining to the upper layer of a body of water that is illuminated by sunlight, allowing photosynthesis to occur and supporting the majority of aquatic life.

Epipelagic

Relating to the upper layer of the ocean, from the surface to about 200 meters deep, where there is enough sunlight for photosynthesis.

Thermal Stratification

The layering of water in a lake or ocean, based on temperature variations with depth, which can affect aquatic life and water quality.

Spring Turnovers

Spring turnovers are the annual mixing of water in lakes and ponds, resulting from temperature changes that cause layers of water to mix, refreshing nutrients and oxygen levels.

Q16: P.L.86-272 _ (does/does not) create nexus when

Q30: Which item does not appear on Schedule

Q33: Any excess of S corporation losses or

Q34: The stock of Tan Corporation (E &

Q48: Which of the following is not a

Q53: Match the following statements with the correct

Q60: What will cause the corporations involved in

Q65: For purposes of tax penalties, a VITA

Q138: Plus, Inc., is a § 501(c)(3) organization.It

Q143: GreenCo, a domestic corporation, earns $25 million