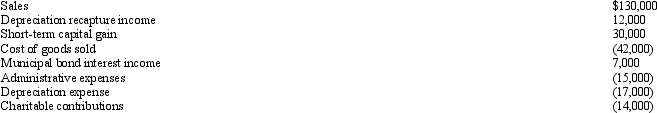

Bidden, Inc., a calendar year S corporation, incurred the following items.

Calculate Bidden's nonseparately computed income.

Calculate Bidden's nonseparately computed income.

Definitions:

Amortized

Gradual reduction of a debt over a period of time through regular payments, which may include portions of both principal and interest.

Fully Depreciated

The status of an asset after its cost has been completely allocated over its useful life, leaving it with no book value.

Book Value

The net value of a company's assets minus its liabilities, as recorded on the balance sheet.

Special Acquisition Fees

Charges or expenses directly associated with the acquisition of a new business, property, or significant asset, often unique and non-recurring.

Q9: The granting of a Writ of Certiorari

Q12: Explain the stock attribution rules that apply

Q18: For purposes of the unrelated business income

Q36: Which of the following statements, if any,

Q63: In the current year, Dove Corporation (E

Q64: Which of the following are organizations exempt

Q86: Rebecca is a limited partner in the

Q91: An S election made before becoming a

Q144: Matt, a partner in the MB Partnership,

Q147: The JPM Partnership is a US-based manufacturing